Making Sense of Medicare Options

And Providing You With OptionsWe Can Help With Your Medicare Options

With our expertise, we hope to make the process of understanding your Medicare options, one that is easy to understand, efficient and affordable. Here at Alford Benefits, we represent several of the major carriers for Medicare Supplement plans (aka Medigap policies) Medicare Advantage Plans, and Medicare Part D drug plans. We will help you find the Medicare Options plan that suits your health care needs, and your financial needs as well. Contact us to learn more.

Find the Coverage that is Right for You

The A-B-C-D’s of Medicare

Part A: Hospital/Inpatient Insurance

Part B: Outpatient Health Insurance

Part C: Medicare Advantage (MA)

Part D: Prescription Drug Coverage

SUPPLEMENT PLANS

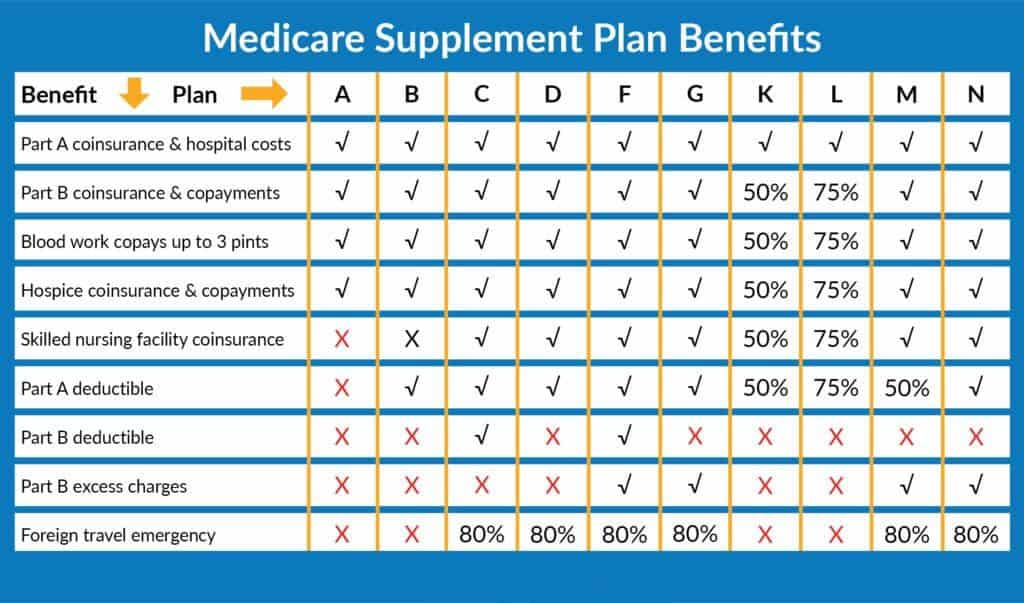

‘Medi-gap’ plans, are used only by people enrolled in original Medicare. Supplement plans are designed to cover some, or most of your out-of-pocket expenses that traditional Medicare does not pay. Supplements generally cover the twenty percent that Medicare A and B do not cover. The Supplement plan may also include coverage for the Part A hospital deductible ($1,484 in 2021) Part B co-insurance and co-payments, medical emergencies abroad, and certain other benefits based on the plan you choose.

Each Supplement plan is standardized by law. The benefits of each plan are identical depending on the letter of the plan you choose. Regardless of which insurance company you select for the Supplement, the coverage from each lettered plan is the same. Medi-gap plans are accepted nation-wide by any provider who accepts Medicare. If the doctor or hospital takes Medicare, the Supplement plan must be accepted as well. Medicare Supplement plans do not include prescription drug coverage. A stand-alone Medicare Part D drug plan is required to cover prescription medications. The three most popular plans in the Medicare Supplement market are Plan F, Plan G, and Plan N.

Insurance companies charge widely different premiums

IMPORTANT: Insurance companies charge widely different premiums, so it is essential to compare prices. At Alford Benefits, we represent many different carriers to ensure you get the lowest rate in your area.

MEDICARE ADVANTAGE PLANS

‘Part C’ of Medicare, this option provides a replacement plan for Original Medicare. These plans must cover the same benefits that traditional Medicare options covers. However, the Part B premium of will no longer go to Medicare. It will go to the Medicare Advantage plan you select. In 2022, the standard Part B premium amount is $170.10 ($164.90 in 2023) (or higher depending on your income).

Medicare Advantage plans can vary in their charges, co-pays, and annual maximum out-of-pocket expenses. Some plans charge a monthly premium on top of Medicare, and many plans can include prescription drug coverage.

By law, all plans have annual limits on out-of-pocket costs. The maximum out-of-pocket charges can be as low as $1,000.00 per year or as high as $6,700.00 per year. It will fluctuate based on the company and plan you chose. A major difference from the traditional Medicare program is that most Part C plans are network confined plans. You are required to see doctors and hospitals in that plan’s specific regional network. Failure to stay in network could result in out of network charges.

SUMMARY

At the end of the day the main difference between a supplement plan and an advantage plan comes down to cost. Supplements are typically more expensive monthly, but have little to no out-of-pocket expenses. You can go to any doctor or hospital in the country that accepts Original Medicare, but prescription coverage is not included.

Where with advantage plans they are typically cheaper monthly, but have thousands each year in out-of-pocket expenses and you are typically confined to a regional network of doctors and hospitals, or you could face out of network charges. However, most, not all advantage plans include prescription drug coverage. Alford Benefits can help you better understand your Medicare options.

Customer relations with

transparent communication ...

Alford Benefits can help you get there.

"Assisting Federal Employees in Texas and Louisiana to understand & take full advantage of their benefits."

Business Address

Suite 112

Houston, TX 77073

Business Hours

Monday - Friday

8:00 AM - 5:00 PM